The global economy is deeply interconnected, and one of the biggest drivers of market movement is trade between the world’s two largest economies: the United States and China. Forex traders pay close attention to these developments, as US-China trade talks can send shockwaves across currency markets.

In this article, we’ll explore how these talks affect Forex markets, why they matter, and how traders can potentially benefit from them.

Why US-China Trade Talks Matter for Forex Traders

The United States and China are the two largest economies in the world, with trillions of dollars in trade between them every year. Any developments in their trade relationship can:

- Influence currency values, especially USD and CNY (Chinese Yuan).

- Affect market sentiment, leading traders to either buy safe-haven currencies or riskier ones.

- Drive volatility in global financial markets, impacting commodities, stocks, and bonds.

In simple terms: positive trade news often strengthens risk appetite, while negative news can cause market panic.

How Trade Talks Affect Specific Currencies

1. US Dollar (USD)

The USD is highly sensitive to trade news because it reflects confidence in the US economy.

- Positive News: If talks indicate a deal is near, USD might strengthen as markets expect improved economic growth.

- Negative News: If negotiations stall or tariffs increase, USD may weaken as trade tensions could slow economic activity.

2. Chinese Yuan (CNY)

China closely manages its currency, but market expectations still play a role.

- Trade Deal Optimism: CNY often strengthens as investors anticipate more exports and stable economic growth.

- Trade Tensions: CNY may weaken, reflecting uncertainty in China’s export-dependent economy.

3. Safe-Haven Currencies (JPY, CHF)

When trade talks sour, investors often flock to safe-haven currencies like Japanese Yen (JPY) and Swiss Franc (CHF), causing them to appreciate.

- Market Volatility: Trade uncertainty can trigger sharp moves in these currencies even if the news is not directly about them.

The Role of Market Sentiment

Forex markets are not just about hard data—they are about expectations. Traders often react before a deal is finalized, based on rumors, leaks, or announcements.

- Risk-On Environment: Good news encourages traders to buy riskier assets and currencies like AUD, NZD, and emerging market currencies.

- Risk-Off Environment: Bad news makes traders seek safety, boosting JPY, CHF, and USD (sometimes).

Understanding market sentiment is crucial for Forex trading during trade negotiations.

Trading Strategies During US-China Trade Talks

Here are some tips for traders navigating the volatility:

- Follow News Closely: Official statements, press releases, and trade reports can move markets quickly.

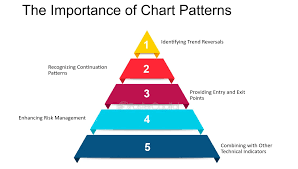

- Use Technical Indicators: RSI, MACD, and Bollinger Bands can help identify entry and exit points during volatile periods.

- Set Stop-Loss Orders: Protect your account from sudden spikes or drops in currency prices.

- Focus on Major Pairs: USD/CNY, USD/JPY, EUR/USD, and AUD/USD are highly sensitive to trade developments.

- Be Patient: Avoid overtrading based on rumors; wait for confirmations.

Historical Examples

- 2018-2019 Trade War: Every announcement of tariffs or trade deals caused significant swings in USD, CNY, and commodity-linked currencies like AUD and CAD.

- October 2025 Framework Agreement: Even speculation about a deal drove USD/JPY and other major pairs to fluctuate as traders adjusted positions.

These examples show how Forex traders must stay alert during trade negotiations.

Key Takeaways

- US-China trade talks have a direct impact on currency values and global market sentiment.

- Positive developments boost risk appetite and strengthen certain currencies, while negative developments create market uncertainty and safe-haven demand.

- Successful trading during these periods requires a mix of news monitoring, technical analysis, and risk management.

- Patience and discipline are essential; impulsive trading can lead to losses amid volatility.

Final Thoughts

US-China trade talks are more than just political headlines—they are powerful drivers of Forex market movements. Understanding their impact allows traders to anticipate trends, manage risk, and capitalize on market opportunities.

Whether you’re a beginner or an experienced trader, keeping an eye on these talks can give you a competitive edge in the Forex market.