Forex trading can be exhilarating. Watching the charts move, spotting opportunities, and making quick decisions can be addictive. But sometimes, too much action can hurt your account more than help it. Overtrading and impulsive decisions are two common traps that even experienced traders fall into. Learning how to avoid them is key to long-term success.

1. What is Overtrading?

Overtrading occurs when a trader takes too many trades in a short period, often ignoring their trading plan. It can happen due to:

- Trying to “make up” for a losing trade

- Chasing the market because of boredom

- Feeling overconfident after a winning streak

The problem? Overtrading increases transaction costs, spreads, and emotional stress—all of which can lead to bigger losses.

2. The Danger of Impulse Decisions

Impulse trading is making quick, unplanned trades without proper analysis. This is often driven by emotions such as:

- Fear: Jumping into a trade to avoid missing out

- Greed: Chasing quick profits without assessing risk

- Frustration: Trying to recover from previous losses

Impulse trades almost always bypass your risk management rules and can destroy consistency in your trading results.

3. Signs You Might Be Overtrading

- You’re trading outside your preferred hours or market conditions

- Ignoring your trading plan

- Constantly refreshing charts and looking for “opportunities”

- Feeling restless when not trading

- Increasing position sizes after a loss

If you recognize these behaviors, it’s time to pause and reflect.

4. How to Avoid Overtrading and Impulse Decisions

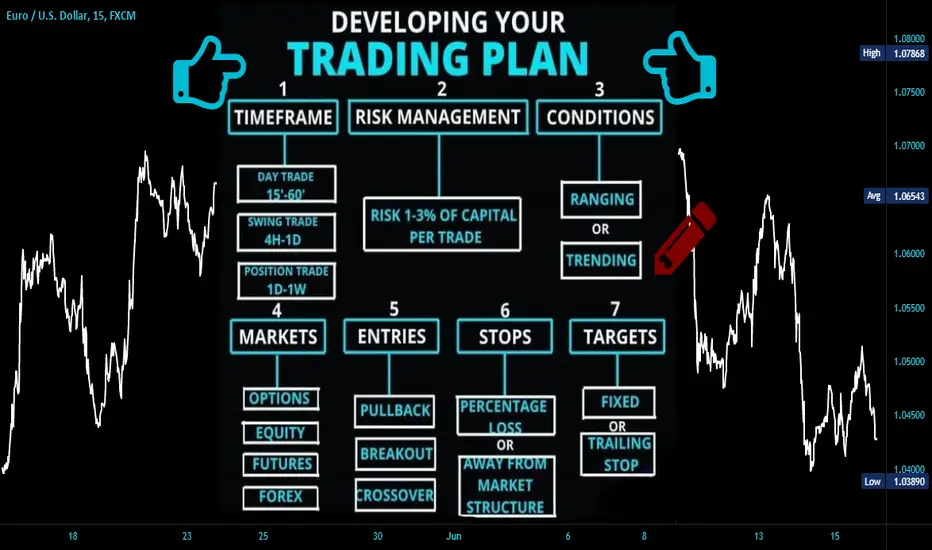

a) Stick to a Trading Plan

A solid trading plan defines:

- Entry and exit rules

- Risk per trade

- Trading hours

- Market conditions

When you have clear rules, it’s easier to avoid trading impulsively.

b) Limit the Number of Trades

Set a daily or weekly trade limit. Fewer high-quality trades often yield better results than numerous low-probability trades.

c) Use Risk Management

Always define your stop loss and take profit. When risk is controlled, the temptation to chase the market decreases.

d) Keep a Trading Journal

Record every trade, including the reason for entering and exiting. Over time, you’ll spot patterns of impulsive behavior and correct them.

e) Take Breaks

Step away from the screen if you’re stressed or emotional. A short break helps reset your mind and prevents rash decisions.

f) Focus on Quality, Not Quantity

It’s better to wait for a high-probability setup than to trade every small market movement.

5. Psychological Tips to Stay Disciplined

- Practice Patience: Wait for the right setups. Markets are always moving—you don’t have to catch every wave.

- Accept Losses: Understand that losses are part of trading. Don’t chase them impulsively.

- Set Realistic Goals: Avoid expecting daily profits. Focus on long-term consistency.

- Mindfulness and Self-Control: Techniques like meditation can help you stay calm and resist impulsive urges.

6. The Benefits of Controlled Trading

By avoiding overtrading and impulse decisions, you can:

- Reduce emotional stress

- Improve consistency and performance

- Preserve your trading capital

- Make smarter, more strategic decisions

Remember: Successful traders trade smart, not fast.

7. Conclusion

Overtrading and impulsive trades are enemies of profitability in Forex. The key to long-term success is discipline, patience, and sticking to your plan. Quality beats quantity, and careful, deliberate trades lead to consistent profits.

Next time you feel the urge to jump into a trade, ask yourself:

“Is this a planned move, or am I just reacting?”

Answer honestly, and you’ll protect both your capital and your peace of mind.