If you’re stepping into the world of Forex trading, one of the most important skills to master is reading Forex charts. Charts are the heartbeat of the market—they show the price movement, trends, and potential opportunities. Learning to interpret them effectively can help you make smarter trading decisions and avoid costly mistakes. In this guide, we’ll break it down step by step, making chart reading simple, enjoyable, and even a bit fun!

Why Reading Forex Charts is Crucial

Forex charts are more than just colorful lines and bars. They are visual representations of the market’s supply and demand dynamics. By reading charts, you can:

- Identify market trends (up, down, or sideways)

- Spot entry and exit points for trades

- Recognize support and resistance levels

- Gauge market momentum and volatility

A trader who understands charts is like a navigator with a detailed map—they can plan the journey and avoid obstacles.

Types of Forex Charts

There are three main types of charts in Forex trading, each with its own strengths:

1. Line Chart

- What it is: Connects closing prices over a selected period with a line.

- Pros: Simple and easy to read; great for beginners.

- Cons: Doesn’t show detailed price action like highs and lows.

Tip: Use line charts to quickly spot overall trends without getting lost in noise.

2. Bar Chart

- What it is: Each bar represents price movement for a specific time frame and shows the opening, closing, high, and low prices.

- Pros: Provides more detail than a line chart; shows volatility.

- Cons: Can look busy for beginners.

Tip: Focus on the highs and lows to identify market strength and weakness.

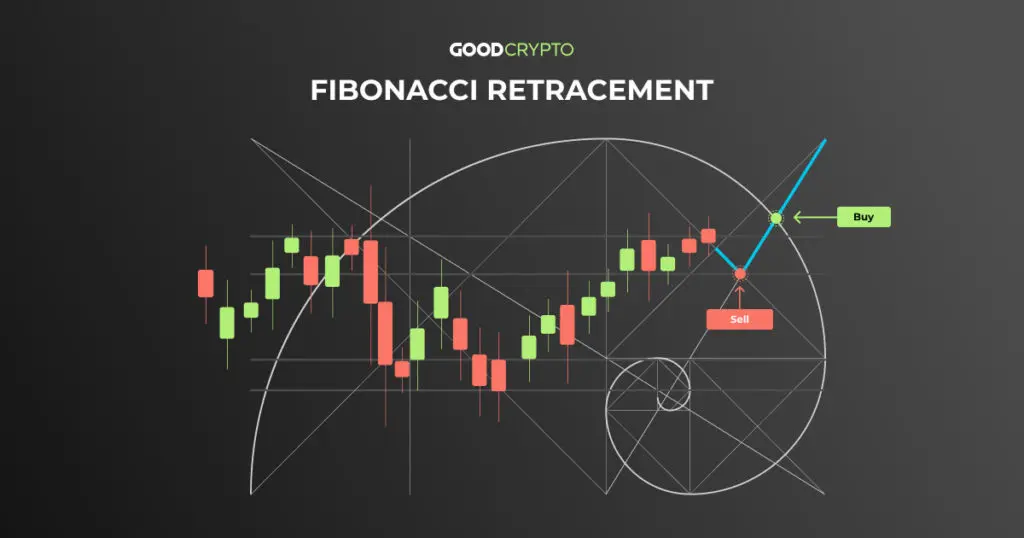

3. Candlestick Chart

- What it is: Shows price action with candles; each candle has a body (open to close) and wicks (high and low).

- Pros: Highly popular among traders; easy to spot patterns and reversals.

- Cons: Can be overwhelming at first due to many patterns.

Tip: Learn key candlestick patterns like Doji, Hammer, and Engulfing to predict potential price movements.

Key Elements to Read on Forex Charts

To read Forex charts effectively, focus on these elements:

- Trendlines: Connect highs or lows to identify the market trend.

- Uptrend: Higher highs and higher lows

- Downtrend: Lower highs and lower lows

- Support and Resistance Levels:

- Support: Price level where buying pressure prevents further decline

- Resistance: Price level where selling pressure prevents further rise

- Tip: Look for repeated bounces; these levels can signal trade entries or exits.

- Volume: Measures the number of trades executed in a period.

- High volume confirms strong trends; low volume may indicate weak moves.

- Indicators: Tools like RSI, MACD, and Moving Averages help confirm trends and momentum.

- RSI: Shows overbought or oversold conditions

- MACD: Indicates trend strength and potential reversals

- Moving Average: Smooths price data to identify trends

Tips to Read Forex Charts Effectively

- Start with the Big Picture: Begin with daily or weekly charts to understand the overall trend.

- Zoom In: Use 1-hour or 15-minute charts for precise entry and exit points.

- Keep It Simple: Focus on a few indicators at first; too many can confuse.

- Watch for Patterns: Recognize patterns like double tops, triangles, and head and shoulders—they often predict reversals.

- Practice Patience: Charts tell a story over time; don’t rush decisions based on a single candle.

Common Mistakes to Avoid

- Ignoring the Trend: Trading against the trend is risky.

- Overcomplicating Charts: Too many indicators can cloud judgment.

- Neglecting Risk Management: Even a perfect chart read needs stop-loss and take-profit planning.

- Reacting Emotionally: Avoid panic trades during short-term volatility.

Conclusion

Reading Forex charts is a skill that transforms you from a trader guessing at prices to a confident market navigator. By understanding trends, patterns, support and resistance, and key indicators, you can make informed decisions and spot opportunities others might miss.

Remember, practice makes perfect. Start with simple line charts, gradually move to candlesticks, and always combine chart analysis with sound risk management. Soon, reading Forex charts will feel like reading a fascinating story—the story of the market itself.