Forex trading can be thrilling, but without a solid trading plan, even experienced traders can lose money fast. Think of a trading plan as your roadmap—it guides your decisions, keeps emotions in check, and improves your chances of consistent success.

In this article, we’ll break down how to develop a Forex trading plan that is practical, actionable, and easy to follow—even for beginners.

Why You Need a Forex Trading Plan

Many new traders jump into the Forex market without a clear strategy. The result? Impulsive decisions, emotional trading, and often, losses. A trading plan helps you:

- Stay Disciplined: Avoid rash decisions driven by fear or greed.

- Set Clear Goals: Know exactly what you want to achieve from trading.

- Manage Risk: Protect your capital with proper stop-loss and position sizing.

- Track Progress: Learn from your trades and improve over time.

Simply put, a trading plan turns Forex trading from gambling into a structured investment approach.

Step 1: Define Your Trading Goals

Start with the big picture. Ask yourself:

- What do I want to achieve financially?

- How much time can I dedicate to trading?

- What level of risk am I comfortable with?

For example:

“I aim to earn 5% monthly returns, trading 1 hour per day, with a maximum risk of 2% per trade.”

Clear goals help you stay focused and measure progress realistically.

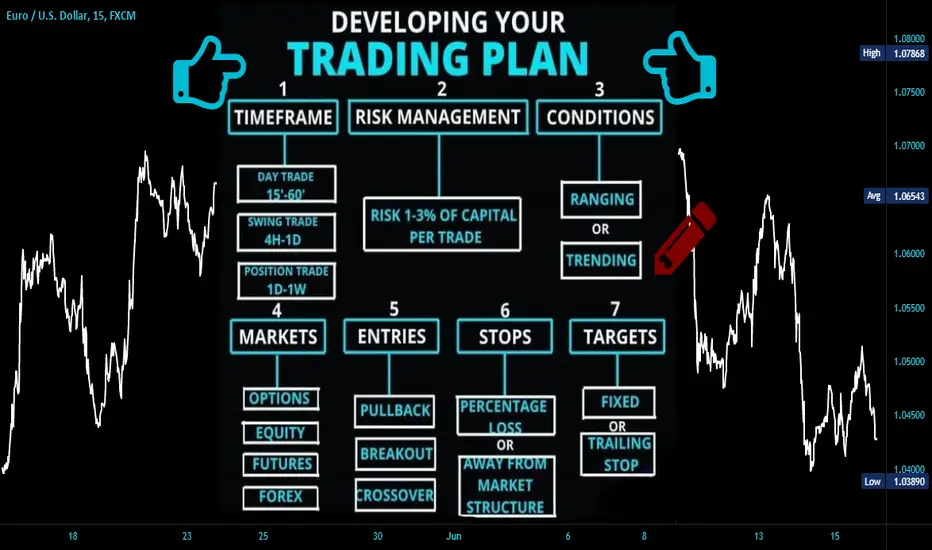

Step 2: Choose Your Trading Style

Your trading style determines how often you trade and how long you hold positions. Common styles include:

- Scalping: Quick trades, minutes to an hour.

- Day Trading: Trades opened and closed within a single day.

- Swing Trading: Positions held for days or weeks to capture trends.

- Position Trading: Long-term trades based on fundamental analysis.

Pick a style that fits your schedule, personality, and risk tolerance.

Step 3: Develop Your Strategy

A trading strategy is your formula for entering and exiting trades. Include:

- Market Analysis: Will you use technical, fundamental, or combined analysis?

- Entry Rules: Conditions that must be met before entering a trade (e.g., RSI < 30 and price near support).

- Exit Rules: When to take profit or cut losses.

- Indicators & Tools: Moving averages, MACD, Bollinger Bands, etc.

Consistency is key—your strategy should be repeatable and testable.

Step 4: Risk Management Rules

No strategy is complete without risk management. Protect your account with these rules:

- Set Stop-Loss Orders: Limit losses on each trade (commonly 1-2% of capital).

- Position Sizing: Adjust trade size based on account size and risk tolerance.

- Risk-to-Reward Ratio: Aim for trades that offer at least 2x potential reward compared to risk.

Remember: surviving losses is more important than chasing profits.

Step 5: Plan Your Trading Routine

Consistency comes from routine. Decide:

- Which currency pairs will you trade?

- What time of day will you trade?

- How will you prepare for the trading session?

For example, many traders analyze the EUR/USD and GBP/USD pairs during London and New York sessions for the most liquidity and volatility.

Step 6: Record and Review Your Trades

A trading journal is your best friend. Track:

- Date and time of trades

- Entry and exit prices

- Trade rationale

- Outcome and lessons learned

Review your journal weekly or monthly to identify strengths, weaknesses, and patterns. This turns mistakes into learning opportunities.

Step 7: Stay Disciplined and Flexible

A trading plan is only effective if you stick to it. Avoid:

- Chasing losses

- Entering trades without confirmation

- Letting emotions dictate decisions

At the same time, update your plan as markets evolve. A good plan adapts but doesn’t compromise its core principles.

Bonus Tips for Beginners

- Start Small: Use a demo account to practice without risk.

- Focus on Few Pairs: Master 1-2 currency pairs before expanding.

- Learn Continuously: Forex markets change—stay updated on news and analysis.

- Mind Your Psychology: Patience, discipline, and emotional control are key.

Final Thoughts

A Forex trading plan is your blueprint for success. It transforms trading from guessing into a methodical process, helping you manage risk, stay disciplined, and grow consistently.

Whether you’re a beginner or experienced trader, the secret to long-term profitability isn’t luck—it’s a well-structured trading plan combined with practice, patience, and discipline.